A stone cold stop out last night. One from three wins so far – the strategy must average one from four to make a profit. In the February campaign, there were nine losses in a row before a late month run of successes that put the month in the black – but it was a severe test of trader patience and persistence. I’m hoping we won’t face a similar situation this month.

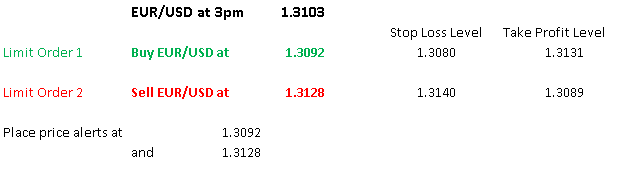

Today’s prices:

And the score sheet:

You can read more about the Five Minutes a Day Trading strategy here.

You can read more about the Five Minutes a Day Trading strategy here.

Hi Michael,

Couple of questions for you:

What was the reasoning to use a buy limit order 12 pips below the Euro open and 25 pips above for sells?

Does this change depending what direction the daily trend is?

Thanks,

Andrew

Hi Andrew – the reasons for the levels are that the analysis of recent trading behaviour showed these levels had a higher profit expectancy – you can read more about it here.

The levels DO NOT change – the basis of this trading is to apply these parameters mechanically everyday

where are the tech notes please…………

Hi Rosemary,

We certainly plan to continue the Morning Technical Notes. They’ll be up and running again on Tuesday

From an inspection of past data (not a rigorous back testing) it seems that changing the buy/sell levels with the trend produces better results. The trend is given by the 50 SMA (50 day simple moving average). If it is up, buy at R-11, sell at R+25, where R is the reference price. If the trend is down, buy at R-25, sell at R+11, and if it is flat, buy at R-18 and sell at R+18.

Yesterday I got stopped out with a small profit (3 pips) instead of a loss because I use a trailing stop of 12 pips when the position moves into the profit zone.

Interesting variation Helmut – thanks for your insights