The AUD/USD pair bounced off an important support level in the last 36 hours, at 1.0150. Today, stronger than expected jobs numbers in Australia added support, but the big picture is deteriorating. A fall through the key support not only signals potential substantial falls, but a sea change in market behaviour.

AUD/USD Weekly

The range-bound, low volatility trading in AUD/USD over the last ten months is the exception rather than the rule in this five year snapshot. Tightly bound in a four and a half big figure range, this sideways trading forced historical volatility to five year lows.

This is likely to change should the 1.0150 level fail. Falls to the low 90’s are possible, establishing a downtrend, and volatility will almost certainly rise. Implications for traders are profound.

Firstly, those trading on charts may wish to consider whether the signals working over the last ten months will remain effective. A more volatile, trending market may push oscillators and stochastics to the back bench. Instead, momentum and trend based technical indicators could become the traders choice. Stop loss orders may be placed farther from entries, and fluctuation assessment tools like the Average True Range could come back into favour.

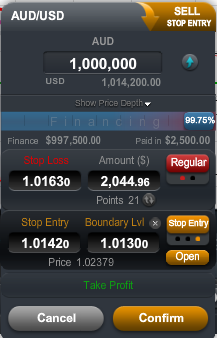

More immediately, traders placing stop entry orders to trade any failure at 1.0150 may consider using wider boundaries on their orders, to ensure they enter what may be a faster moving market. Something like:

Nice trade. Would be in the money this morning.

Do you hold any weight to the idea of a contracting triangle on the weekly chart. Wave E should hit the lower line at around .99. With a 100% of wave A price target of 113?? I guess we will find out this week.

Thanks Ritchie – please see Ric’s blog today