Who will win the currency wars? Central banks in the US, UK, Europe, Japan and China all want to see their currencies weaken, regardless of whether this is their stated aim. The AUD is a bobbing cork in the global sea of increased liquidity.

Although it’s hard to pick the winner of the currency wars, it seems likely that the AUD will be a casualty, and that the AUD could go significantly higher over the medium term. That is, the AUD could strengthen against currencies that are increasingly liquid.

Here’s the big picture:

AUD/USD Daily

The recent daily down trend is clearly broken. The inside range between 1.0150 and 1.0580 remains intact. While a down trend breach does not always mean an up trend will start, it appears the risks are now on the upside for AUD/USD.

For some traders, it becomes a question of entry method. There are many possibilities, and only the individual can determine the “right” entry for their personal situation. Looking at the 4 hour chart, two potential entries come to mind.

AUD/USD – 4 Hourly

It’s possible AUD/USD could pull back to the zone around 1.0270. Some traders may try to fish for a lower entry, employing a stop loss below 1.0260. However, the persistence of the rise over the last 20 hours may have other traders conemplating a 1,2,3 entry – buying if and when there is a rise above 1.0335.

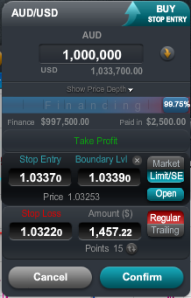

A stop entry order allows a trader to concentrate elsewhere while waiting for the move:

The AUD’s direction is largely dependent on that of the USD.

Most analyses I have read recently indicate EUR/USD declining towards 1.26 area, especially with a break of 1.2960 which the market has tested three times, although in my opinion not too arduously.

Apreciate your view on EUR/USD?

Hi Tony – one of the consequences of the currency wars is that correlations are changing, and there is more “independent” movement of currencies – its no longer USD vs the rest. Under thsi scenario, EUR/USD could fall (stronger USD) but AUD/USD still go up (ie much weaker EUR/AUD). Tend to agree that EUR/USD will crack support at 1.2970 and head towards 1.26 – think we could see 1.22 before year is out.

Hi Michael. Did this trade just get triggered both on the buy and the sell. Re William.

Hi William – the buy is a stop entry – that is a buy order that is triggered when the market rises to the order price. At this stage the example trade would be “live” – the buy was triggered by the move over 1.0337, and the stop loss is not triggered.

Pingback: AUD/USD – Boundary Protection | CMC Markets Blog